Archive for the ‘Destinations’ Category

The Philippines aims for Spain

I recently had the pleasure of assisting the Philippines Department of Tourism in organizing a first “exploratory” mission to test the potential of the Spanish outbound travel market. The strategy behind the mission, headed by former advertising entrepreneur, Secretary for Tourism Ramón Jiménez, was well thought out and, in my view, an original and “cleverly simple” approach to the market.

Secretary Jiménez, right, explaining his creative and strategic approach to journalists during his visit to Madrid.

Secretary Jiménez’s route plan was was two-pronged. The overall objective was clearly to increase the number of Spanish visitors to the Philippines but to achieve this he identified two strategic objectives as KPIs and unavoidable milestones:

1. Association of the brand values of Spain and the Philippines. Here the big idea is that by positioning the Philippines as “The Spanish Asia” the two country brands will compliment and support each other. Although Spain has all but forgotten it once had a colony in South East Asia, the undeniable reality is that the religion, gastronomy, culture and even sense of fun that the Spanish brought to the Philippines have endured to this day and now form part of the destination’s personality and tourism DNA. In the days of global travel it is in the mutual interest of both Spain and the Philippines tell the world of their common brand values. The countries are as close culturally as they are distant geographically so there would never be any issue of competition between them however the insinuation in co-branding is that any European that enjoys a holiday in Spain would also enjoy the experiences offered by the Philippines whilst the increasing numbers of Asians that choose to holiday in the Philippines (because “It’s more fun in the Philippines) should also enjoy a holiday in Spain. It is a bold and original strategy but one which actually makes sense as Secretary Jiménez explained to his Spanish counterpart José Manuel Soria.

2. Encourage Spanish hotel brands to invest in the Philippines.

The logic is clear, if Spanish tour operators see that the Spanish hotel chains have invested in a destination, then this offers reassurance for the travel agents and end consumers. Most of the international development of Spanish hotel chains is focussed either in Europe or in South America. Cultural, historical and lingüistic affinity with former colonies is something that attract both investors and tourists. As Minister Jiménez said: “The Brits go to Malaysia and Singapore, The Dutch go to Indonesia, the French to Vietnam and even the Portuguese look to Macau but the Spanish have forgotten “their” base in Asia”

Each objective supports the other: If the global positioning of the Philippines as the Spanish Asia is to be credible (not just in Spain but to other regional source markets that see Philippines as a local experience similar to Spain), it is important that the Spanish hotel groups have a visible presence in the destination.

Both events were very successful and I am confident that we will soon be hearing much more about the Philippines here in Spain. A couple of the hotel chains were seriously interested in investing and at least four of the tour operators that came to the workshop have already confirmed their intention to include the Philippines in their next brochure. That said, a quick look at the data we pulled from Forward Keys shows, there is certainly room for growth in market share. If they promote with the same professional criteria as they have approached this “toe in the water” exercise then my money is on at least double-digit growth this time next year.

Do workshops work?

“Do workshops work?”…I wonder how many tourist boards, and travel industry partners have asked themselves this simple question and how many take it as a one of the dogmas of the destination marketer’s creed. Workshops, together with trade fairs have, for years, been the cornerstones of most destination marketing strategies and few are the heretics brave enough to question their effectiveness. As budgets are cut and ROI is king (not just in French!) even the “Must dos” and or “Just dos” of destination marketing have to stand up to the “why do?” test.

Now, I am not saying that workshops are no longer useful for the travel industry and specifically for the Spanish outbound tourism industry but I have been organizing workshops for the last 20 years and each year it is harder to get relevant buyers to attend. So much in our industry has changed in the last couple of decades… the way we work and the way consumers plan and buy travel have been transformed by internet, global online distribution, social media, and yet the good old 20th century invention of the workshop stands firm and more or less unchanged.

Back in the 80’s workshops were a great tool. The Spanish outbound industry was just taking off as post-Franco Spaniards were free to travel and economically capable of doing so for the first time. The outbound industry was in it’s infancy and tour operators urgently needed to contract product and make new contacts with suppliers. They were grateful of the chance to make contacts without leaving Spain (many didn’t speak English!). Likewise the sellers had no way of contacting these new product managers and they were grateful to their national tourist boards for putting them in contact.

But today the outbound industry has matured and most product managers have expert knowledge of the destinations they sell and strong, long-lasting relationships with suppliers. Moreover, if they do not have a contact they can very easily find one online.

Incoming agencies participating in the workshops in Spain also need to be aware of the particular structure of the outbound industry here that means that retail travel agencies cannot sell their products unless they come from a wholesale agency and thus many of the travel agents that attend workshops are, at best, there to get some general information about the destination and more often than not they are there to meet each other and have a free drink.

Our most recent request from a Tourist Board to organize a workshop came from Iceland. “We want to do a workshop” they said, “why?” said we. By “why?” I meant more “what do you plan to achieve?”. As it happens, Iceland is doing very well as a destination, even in the depressed Spanish market, (more on that in another post) and yet relatively few tour operators program it and relatively few retail agents know how to sell it. The tourist board and nine private sector partners wanted to convince more wholesalers to create new packages and more retail agents to sell them. In the current situation in Spain with tour operators reducing costs by cutting jobs, it is not easy to persuade decision makers to take time to leave their offices to attend events. So we went to see them instead. We selected 10 tour operators in Madrid and 10 in Barcelona that don’t sell the destination but have the potential to do so. We split our Icelandic delegation into two groups and fixed agenda of 45 minute meeting in each tour operator’s office. At lunch time we had a presentation and networking session for 60 retail, wholesale-retail and wholesale agents in each city. At the end of it all the Icelandic trade partners were exhausted but extremely satisfied.

So the idea of coming to Spain to meet the trade is still a good one but the concept needs to be tailored to the specific objectives of each destination and it is no longer enough to put a bunch of brochures on a table and go home with a case full of signed contracts.

The short guy with a bloody leg and hand baggage only

As part of a project I am doing for one of my clients I have been preparing a presentation to help put the Spanish outbound market into context and proportion. In the family portrait I am painting the body is proportionate to the total population, unemployment is represented as a blood-red bandage on the leg and the GDP as the size of the suitcase. The numbers are eloquent but if you, like me, find it easier to think in images then the picture speaks louder than a thousand numbers. Sweden is the smallest market in terms of population but its GDP is disproportionately large. The Dutch and the UK have pretty balanced measurements and yet Spain is a pretty unattractive mix of a relatively short guy with a badly broken leg and a GDP that would look small even in one of those grotty chocolate boxes Ryan Air use to measure hand luggage at the gate.

Before you complain that not all the European markets are in my picture I ought to mention that we only considered the markets in which our client is actively promoting itself as a destination.

For those of you that think in numbers, here are the stats drawn courtesy of Eurostat from which the graphic was drawn.

| Spain | Germany | UK | France | Holland | Sweden | Italy | |

| Population(Millions) | 46.958 | 80.557 | 64.231 | 63.821 | 16.795 | 9.595 | 59.787 |

| % Unemployment | 26.90 | 5.30 | 7.70 | 10.40 | 6.60 | 7.90 | 12.20 |

| GDP (Mill €) | 260.501 | 669.920 | 463.413 | 512.379 | 150.845 | 408.467 | 389.042 |

The good news is the looks are not always everything and for the client in question Spain is still the number one source of tourists in all of Europe and despite the gammy leg they had a record year last year with 5% growth.

Chile on tour. Lessons from the frontline.

One of my more memorable meetings of the last couple of years was totally unexpected. I was doing my usual rounds at the WTM last November when I decided to pop in to say hello to Chile. Secretary of state for Tourism, Jaqueline Plass, spotted me like a spider spots a fly close to her web and lured me into the meeting room on their stand with a charming smile and an irresistible glass of Chilean red wine (she knows my weak points!). As soon as the door was closed she hit me with a “So Chris, what would happen if we don’t go to FITUR?”. The smile was still there but the wine disappeared in one gulp as I tried to focus my mind for a coherent answer with the sense of panic I imagine the fly feels when tangled in the web. All I could come up with as all eyes in the room stared at me in expectation was “um, ur, well …nothing really”.

Well these Chileans are nothing if not pragmatic. The ROI is king (linguists will excuse the French pun!), and if there is no clear business reason for doing something then they simply don’t do it. I am not saying that FITUR it doesn’t have its “raison d’être” but I have to admit that justifying a large stand purely in terms of return on investment is quite a challenge (even to the sales team at FITUR).

I already discussed Fitur in my post at the time Chile announced they were not going. Today’s note is to share with you the experience of the event we did in lieu last week with some of the budget Chile saved from FITUR.

First we analyzed the real expectations of FITUR for the destination: B2B Meetings with tour operators really interested in South America (realistically we are talking about 20 buyers to target in Spain), make contacts with MICE agencies (something you rarely achieve at FITUR as they prefer EIBTM and IMEX), present the destination to retail travel agencies, showcase the image of the destination to end consumers and media. Then we looked at where the customers, both B2B and B2C were (Madrid and Barcelona). With all this in mind we designed a mobile exhibition concept that would allow us to meet all these targets in 2 days in Madrid and 2 days in Barcelona.

In just one exciting, albeit exhausting, week we held two workshops for tour operators, four agency training seminars, two MICE agency presentations, two media presentations and two blogger presentations. These events were attended by: 26 tour operators, 21 MICE specialists, 90 retail agents, 30 bloggers and 60 journalists. At FITUR you would be extremely hard pushed to make this many useful contacts. Furthermore thousands of potential consumers visited the multi-sensorial, multimedia exhibition many participated in our consumer competition, took photos with our Chile backdrop, became fans of our facebook fan page or simply enjoyed our shows of traditional dance and music. Thousands more saw the Chile destination branding on the trailer as it was parked in the seafront in Barcelona and outside the Santiago Bernabeu stadium in Madrid or even as it drove around town. The novelty of the promotional format also proved attractive to the media and so far we have picked up over 50 positive press cuttings about the event.

Without going into too much financial detail I can say that all of the above was achieved for a total investment that represented a saving of very nearly six figures on what Chile spent on their last stand at FITUR.

The experience, particularly in Barcelona also highlighted a new justification for promotion in Spain. As I am responsible for the development of the Spanish market I was concerned that there would be more foreign tourists walking by than Spaniards, as these would be a distraction. In the event however this was a big advantage for the destination because it answered the inevitable questions raised back in Chile about “why are we doing this big promotion in a country in recession?” By coming to Spain you can promote the destination to real tourists from around the world. This, together with the fact that Madrid is the hub for most flights to South America, adds value and justification to any promotion of this sort in Spain. The problem is that many destinations still don’t get the big picture and continue to split their budgets and activities among source markets and they only measure only impact on each of these markets. Luckily we had multilingual staff on hand and were able to give the tour of the exhibition in English, Russian, German, Danish and Italian but unfortunately all the printed information was in Spanish.

We have learnt a great deal from this first roadshow event and we made other mistakes or oversights along the way (time of the year, locations, quality and length of presentations, etc.), that will allow us to fine-tune the concept for the future but we got excellent feedback from trade, press, consumers, partners and Jaqueline Plass herself (who stoically stayed with us 12 hours-a-day for the whole week as another example of the responsibility and accountability of politicians in Chile).

Standing next to some of their competitors, Turismo Chile’s promotional budget looks thinner than the country does on the map but I have to say that they do not waste a cent and they are an example of how a strategic, practical and responsible use of resources, however limited, can make a real impact on the market.

Media Spend by Latin American Destinations

Back in 2008 I was mainly marketing, short-haul European destinations to the Spanish outbound market. They had the money and they had the market (about 90% of travel from Spain was to Europe and still today Europe accounts for 85% of the outbound market). When the black clouds were first seen looming over Spain’s economy the European destinations were the first to drop everything and run for shelter. In just one year the same number of my client destinations invested just over one million euros less in marketing activities in Spain and this is illustrative of how the market changed almost overnight.

Several things coincided:

1.Spain as a source-market was obviously in trouble

2.The European destinations themselves were suffering their own economic problems and budget cuts

3.European destinations were selling less and less through tour operators and travel agencies and more directly to the consumer online. Thus there was less scope for co-marketing campaigns to share costs.

Media spend by short-haul destinations all but disappeared overnight. Latin American destinations have however continued to invest in promotion as Spain continues to be a significant source market for them (albeit more because of historic, cultural, commercial and family ties than “Tourism” with a capital T).

To get an idea of the competitive climate for these Latin American destination in the Spanish outbound market, it is interesting to look at which Latin American destinations are investing in media, how much they are spending and what they are buying. As we are now working for two national tourist boards and one airline in the region I asked a friend at Iris Media (a media planning agency with lots of tourism clients) to do some competitive analysis. To get the full analysis you have to be either my client or that of Iris Media but I would like to share some of the basic data (itself from Infoadex) as a general eye-opener.

The first thing that strikes me is that the overall investment is still remarkably low. A total of just 692,386€ was spent on advertising by the seven main players in the region, (we didn’t include Caribbean or Mexico as these are subject of a different analysis). Even more remarkable is that Peru accounts for over half the total investment (349,000€) from the region.

Coincidentally, just last week I had the great pleasure of meeting PromPeru’s director, Mªdel Carmen de Reparaz at the Marktur Forum event in Buenos Aires. I was there to explain to Latin American destinations how to do effective PR on a shoestring and looked on in admiration (and envy!), as Mª del Carmen presented the successful past campaigns (including an ambitious co-marketing campaign with Viajes el Corte Inglés) and the spectacular new cinema commercial for Perú. Where do they get the money from? Well they levy a 15$ charge on every foreign tourist entering the country and this money goes into PromPeru’s marketing budget, the more international visitors they get, the more they have to invest and so the spiral grows. It certainly seems to be working because last year, despite the recession Peru managed to increase tourism from Spain by 11%. So whilst Chile has a total marketing budget of just 2 million dollars for the whole world, Peru has 80 million.

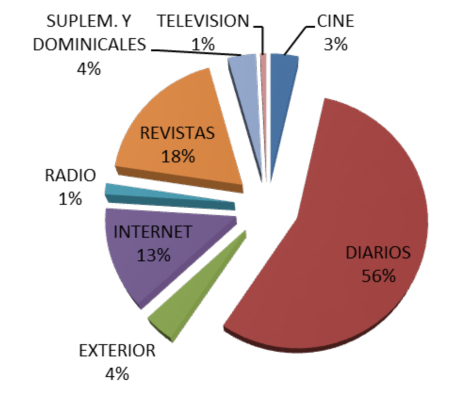

It is also interesting to see how destinations are investing their budgets. Together, the seven countries we looked at split their budgets among the different media as follows:

Our research has shown that the most cost-effective combination for destination promotion to the Spanish tourist is online + outdoor and yet a whopping 56% of the budget still goes to daily newspapers (print). The explanation for this is that there are still many destinations that invest only in co-marketing campaigns with local Tour Operators. I am a huge fam of co-marketing in principle as it supports image advertising with a tactical call to action and it multiplies the destinations marketing budget. The only problem is that all-too-often the local tour operators are responsible for doing the media plan and they choose the media where they have the best deal (and not necessarily the best media for the job) and traditionally the daily newspapers have been the most generous with their bulk-purchase discounts to tour operators. Anyway this is the subject for future post so for now I’ll just mention that Colombia seem to have the richest and most creative mix of media and last year they made a huge impact on the market.

Spanish arrivals in Ecuador up 8%

I am proud and delighted to say that the Ministry of Tourism of Ecuador has recently appointed my company (Interface Tourism Group) as its representative in Europe. From our office here in Madrid, we will coordinate all the promotion of Ecuador in all six of its priority markets in Europe: Spain, Germany, UK, France, Netherlands and Sweden.

To Fitur or not to Fitur?

That is the question….the question that many national tourist boards are asking themselves. The mere fact that destination marketers are asking themselves and their trade partners whether or not it is worth attending Spain’s main travel event is itself a sign of the times. Fitur has been an unquestionable red letter week in our diaries for years. In my case, for 23 years Fitur, fondly referred to in the office as the “F word”, has deprived me of a relaxing Christmas holiday and kept me running around like a headless turkey in frantic preparation for the most important week in the calendar.

Well this year, for the first time in my career, none of the destinations I represent will be attending. This is not because I have advised them not to (I am still trying to change my own mindset to kick the habit of a quarter of a century), but because commercial logic and common sense have advised against blowing a significant part of an increasingly insignificant budget on 3 days of trade a 2 days of consumer madness.

This year Kenya, for example, has decided that it was worth going to niche product but multi-market fairs such as the IGTM in the Algarve for golf tourism or EIBTM in Barcelona for MICE but not FITUR which they consider a generalist fair for a single market (that is not particularly buoyant right now). Kenya is a popular destination in the market and they will be missed but it is not too much of an issue for FITUR as they have been coming on and off for years with a stand that of never more than 40m2.

The big news this week was Chile’s decision to pull out of the fair after last year’s emblematic and impressive 400m2 showcase costing a total sum of very nearly six figures. This is a serious blow to FITUR as it leaves a sizeable hole in the middle of the Americas hall that has traditionally been the liveliest of the international side of the fair. The Chileans are nothing if not pragmatic and if the return on investment is not clear then they don’t invest. Actually, to be fair, both in the case of Chile and Kenya it was lack of interest from private sector co-exhibitors that brought about the decision not to participate. National tourist boards are more or less obliged to raise the flag around which the private sector and regional CVBs can gather and sell their wares but if there is little or no interest in from the private sector in exhibiting there is little point in using public sector funds to fly the destination flag. Last year I was working on five national tourist board stands and this year, so far none have confirmed they will be there and 3 have confirmed they won’t.

So what has gone wrong? I hate to say “I told you so”…but just after the last edition of the fair I wrote a post here expressing my concerns for FITUR’s future unless they seriously reinvented themselves and managed to find its own niche. The obvious opportunity was to put together a system of hosted buyers from South America and position FITUR as the bridge between Europe and Latin America. Not only have they missed this opportunity, they have not been able to prove the value of the fair to one of the main exhibitors in the region (Chile) and to add insult to industry they have managed to annoy just about every blogger in South America with a carelessly put together mechanic for a competition. Without the South America link FITUR basically becomes an over-priced marketing activity for the Spanish market only and with the bad press Spanish is getting in the international media it is hardly surprising that private companies aren’t queuing up to invest.

WTM and ITB, despite being in the two most important sources markets in Europe were awake enough to see hard times coming and prepare sensible strategies based on adding value to their events for both exhibitors and buyers. As a result they have consolidated their position as meeting points for the global tourism industry. Whether you are interested in the fairs themselves there is plenty going on at WTM or ITB in terms of seminars, think tanks, presentations, etc. to make them well worth a visit…and of course everybody does visit and that adds huge networking and socializing value. FITUR have made an attempt to innovate in this sense with Fiturtech, hosting Investour creating a specific LGBT area, etc. but these innovations have come too late and at a time when FITUR does not have the budget to adequately promote them as events in their own right.

Spanish tourism to Jordan up 22%

Always nice to start the week on a positive note. Despite the difficult year for Spain as a source market, there are still destinations that are able to produce positive figures. Admittedly Jordan suffered a drop in tourist arrivals last year as a result of the turmoil in the region (though not in Jordan) during the Arab Spring but nonetheless the 22% increase they are showing this year is an excellent performance.

Arab destinations with strong cultural heritage are always attractive to the Spanish traveler. Perhaps because of the cultural affinity after centuries of moorish rule in Al Andalus, perhaps because of its geographical position of buffer zone between Europe and North Africa the fact is there has always been a fascination for the region by Spanish tourists. So far this year 23.731 Spanish tourists have enjoyed a trip to Jordan.

One-way tourism will bring the returns.

For the first time in over 30 years Spain’s population is actually going down as more people are emigrating from than immigrating to Spain and many young couples are leaving parenthood till “after the crisis” or at least until the government stops cutting child benefit and increasing education costs. More and more qualified professionals, university graduates and even entrepreneurs are setting up residence in any country in a position to offer them the opportunity that has been denied then in Spain. Countries of choice include: Germany, Brazil, Canada, Australia or Chile. Just this week there was an announcement that Austria was offering no less than 5,000 opportunities in the hotel industry to Spanish tourism professionals.

A couple of weeks ago I was discussing this with the Director for Europe for Turismo Chile, a client of mine, who was at first skeptical, quite rightly so of course, of the positive growth statistics of Spanish arrivals to Santiago de Chile. Talking to the incoming tour operators (and indeed to the outbound operators here in Spain) it is clear that many are entering on a tourist visa, finding a job while they’re “on holiday” and staying for good. They are not, strictly speaking, tourists at all.

This was obviously a bit of a dampener on my argument that our marketing is so damn good it can persuade more and more people to spend upwards of 3000€ on a jolly to Chile despite the worst recession in history (well it was worth a try!) but on reflection it is not that bad news at all. Firstly because the situation would be a good deal worse if we weren’t doing the marketing. Secondly because our country branding, which we do in collaboration with ProChile, the commercial attaché to the embassy, is no doubt contributing to the positive image that Spanish professionals have of Chile a pleasant place to live and work. Lastly but most importantly because there will be mid-term and long-term benefits to tourism from this emigration.

Remember these are definitely not the Spaniards we saw emigrating in those sad black and white movies from the 1950’s. Back then it was the unqualified manual worker that was forced to leave the wife and kids behind and seek fortune or evade misfortune abroad. Today it is the opposite as there is a veritable brain-drain as the most qualified young doctors, engineers, programmers, etc. leave behind the mums and dads that paid for their masters degree. These talented, highly qualified but frustrated yuppies are sought after by countries capable of tempting them with high salaries and a high quality of living. They will soon therefore have more money to spend and one of the first things they will want to do is explore the country that they now call home. Good news therefore for a tourist segment I call the “new-domestic” . When they return to Spain they will be powerful advocates of their adopted country and therefore the best possible marketing campaign for the destination. In the meantime, and even if they never return to Spain at all, friends and family will want to visit them and this will boast the V.F.R. segment and also multiply the destination advocates.

Last but not least, in the case of Chile, many of these Spanish immigrants end up working for Spanish multinationals in Chile thus strengthening the commercial links between the countries and with it the MICE and business tourism segments.

Whilst our objective is obviously to send tourists and not immigrants to the countries we represent I am convinced that the latter will lead to the former so we must be patient and wait for those one ways to bring the returns.