Archive for the ‘Research’ Category

Spanish Outbound Rebounds

No, I don’t mean this blog is rebounding. I hope you’ll forgive me but I have recently started a new job and continue to be chairman of Interface Tourism Spain and father of 3 kids so I’m afraid time available for selfless sharing of market intelligence is limited to a window between 11.45 pm and 3.00 am. However, I did think that this press release by my friends at ForwardKeys was worth sharing.

Sebastian Cron of Forwardkeys handed me this release in one of many chance meetings in the corridors of this year’s FITUR. By the way, FITUR, as usual, claimed record numbers of visitors (both trade and public) with trade visitors up 5%. I am always sceptical of their “official” figures and to my eyes the show had definitely shrunk again in floor space. That said there was undoubtedly more business being done this year and a more positive and optimistic atmosphere in general. Also a couple of my clients, who had been notably absent for the last few years were back again this year (Chile, Philippines) and both said the ROI from participation was better than when they were last here.

Anyway the title “Spanish Outbound Tourism Rebounds” was Forwardkeys’ and not mine and here is the rest of their press release word for word:

Forward Keys, which monitors future travel patterns by analysing ~70m booking transactions a day, crunching more daily traveller data than anyone else, is seeing 6.3% growth in bookings for international departures from Spain during the first quarter of 2015.

Olivier Jager, Co-founder and CEO, Forward Keys, commented: “We are seeing highly encouraging booking trends. Spanish outbound bookings for travel in February are up by 10.7% and bookings for March are currently up by 46.5% compared to the equivalent time last year. This tells us that travellers are booking earlier and/or that there will likely be a bigger volume of departures in the first quarter of 2015. Whichever way you see it, these numbers are grounds for optimism.”

Looking at the top destinations for Spanish outbound, most countries are up on where they were at the same time last year. The big winners are the Middle East and Latin America. Bookings to the UAE are 41% up on last year, no doubt thanks to increased flight connectivity between Dubai and Spain, as well as various leisure and business events in the Gulf in January.

Bookings for Chile and Argentina also show a substantial increase compared to last year, up by 23.8% and 17.9% respectively, which can most likely be explained by a new code-share agreement between the Spanish national airline Iberia and the Latin American carrier TAM that makes it easier for Spanish travellers to go to South America.

The promising start to 2015 follows a recovery in 2014. Overall departure from Spain grew 3.2% last year, a welcome rebound from the 2012 global economic crisis, where yearly departures fell 6.2% from 2011.

Among the top destinations in 2014, the notable improvers were Turkey up 14%, the USA up 11%, Portugal up 9%, Germany up 7% and the UK up 5%.

Certainly cause for optimism then, particularly for long haul destinations. Just a warning from taking these figures too literally. Extremely valuable and eloquent though they are: Remember that ForwardKeys monitors only the flights booked using a GDS. Their analysis does not therefore include charter flights, low cost airlines or direct bookings not using GDS, or, of course any other forms of transport. In the case of European travel therefore the trends might be the same but you can’t really get an accurate picture of intra-european travel without including low-cost airlines, train or cars. Outbound flights booked using GDS systems (essentially Amadeus) have however increased in the last 12 months so the overall trend is undeniably positive.

The Spanish idea of a holiday

I did this simple graph with data from the Spanish government’s Instituto de Estudios Turísticos (IET) study Familitur which endeavours to describe the Spanish tourist’s habits and motivations. I try to keep this image in mind when advising clients on content for their destination websites, brochures and media campaigns. With so much beach of their own it is not surprising that sun and sea are not main motivators for travel abroad (but they do like beach destinations that also offer opportunities to interact with the locals). If we were to put together an itinerary for a group of “average” Spanish tourists according to this data it would probably look something like this:

Get up (not too early) and go to see the sites and visit a gallery/museum/monument. Then have a good lunch with the best local food available. In the afternoon do a spot of shopping for souvenirs for friends and family (looking for “typical” things unique to the destination and not global brands). Back to the hotel to freshen up, out for a nice dinner and the to party!

But then we know that since micro-segmentation and big-data there is no such thing as an “average tourist”.

The short guy with a bloody leg and hand baggage only

As part of a project I am doing for one of my clients I have been preparing a presentation to help put the Spanish outbound market into context and proportion. In the family portrait I am painting the body is proportionate to the total population, unemployment is represented as a blood-red bandage on the leg and the GDP as the size of the suitcase. The numbers are eloquent but if you, like me, find it easier to think in images then the picture speaks louder than a thousand numbers. Sweden is the smallest market in terms of population but its GDP is disproportionately large. The Dutch and the UK have pretty balanced measurements and yet Spain is a pretty unattractive mix of a relatively short guy with a badly broken leg and a GDP that would look small even in one of those grotty chocolate boxes Ryan Air use to measure hand luggage at the gate.

Before you complain that not all the European markets are in my picture I ought to mention that we only considered the markets in which our client is actively promoting itself as a destination.

For those of you that think in numbers, here are the stats drawn courtesy of Eurostat from which the graphic was drawn.

| Spain | Germany | UK | France | Holland | Sweden | Italy | |

| Population(Millions) | 46.958 | 80.557 | 64.231 | 63.821 | 16.795 | 9.595 | 59.787 |

| % Unemployment | 26.90 | 5.30 | 7.70 | 10.40 | 6.60 | 7.90 | 12.20 |

| GDP (Mill €) | 260.501 | 669.920 | 463.413 | 512.379 | 150.845 | 408.467 | 389.042 |

The good news is the looks are not always everything and for the client in question Spain is still the number one source of tourists in all of Europe and despite the gammy leg they had a record year last year with 5% growth.

Media Spend by Latin American Destinations

Back in 2008 I was mainly marketing, short-haul European destinations to the Spanish outbound market. They had the money and they had the market (about 90% of travel from Spain was to Europe and still today Europe accounts for 85% of the outbound market). When the black clouds were first seen looming over Spain’s economy the European destinations were the first to drop everything and run for shelter. In just one year the same number of my client destinations invested just over one million euros less in marketing activities in Spain and this is illustrative of how the market changed almost overnight.

Several things coincided:

1.Spain as a source-market was obviously in trouble

2.The European destinations themselves were suffering their own economic problems and budget cuts

3.European destinations were selling less and less through tour operators and travel agencies and more directly to the consumer online. Thus there was less scope for co-marketing campaigns to share costs.

Media spend by short-haul destinations all but disappeared overnight. Latin American destinations have however continued to invest in promotion as Spain continues to be a significant source market for them (albeit more because of historic, cultural, commercial and family ties than “Tourism” with a capital T).

To get an idea of the competitive climate for these Latin American destination in the Spanish outbound market, it is interesting to look at which Latin American destinations are investing in media, how much they are spending and what they are buying. As we are now working for two national tourist boards and one airline in the region I asked a friend at Iris Media (a media planning agency with lots of tourism clients) to do some competitive analysis. To get the full analysis you have to be either my client or that of Iris Media but I would like to share some of the basic data (itself from Infoadex) as a general eye-opener.

The first thing that strikes me is that the overall investment is still remarkably low. A total of just 692,386€ was spent on advertising by the seven main players in the region, (we didn’t include Caribbean or Mexico as these are subject of a different analysis). Even more remarkable is that Peru accounts for over half the total investment (349,000€) from the region.

Coincidentally, just last week I had the great pleasure of meeting PromPeru’s director, Mªdel Carmen de Reparaz at the Marktur Forum event in Buenos Aires. I was there to explain to Latin American destinations how to do effective PR on a shoestring and looked on in admiration (and envy!), as Mª del Carmen presented the successful past campaigns (including an ambitious co-marketing campaign with Viajes el Corte Inglés) and the spectacular new cinema commercial for Perú. Where do they get the money from? Well they levy a 15$ charge on every foreign tourist entering the country and this money goes into PromPeru’s marketing budget, the more international visitors they get, the more they have to invest and so the spiral grows. It certainly seems to be working because last year, despite the recession Peru managed to increase tourism from Spain by 11%. So whilst Chile has a total marketing budget of just 2 million dollars for the whole world, Peru has 80 million.

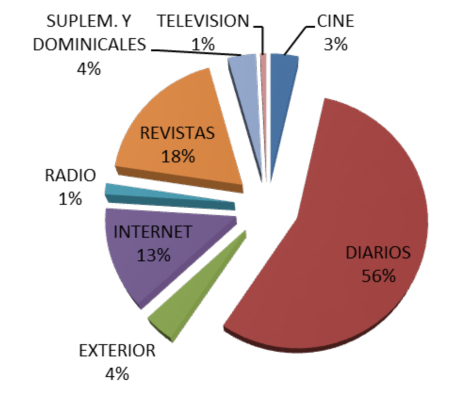

It is also interesting to see how destinations are investing their budgets. Together, the seven countries we looked at split their budgets among the different media as follows:

Our research has shown that the most cost-effective combination for destination promotion to the Spanish tourist is online + outdoor and yet a whopping 56% of the budget still goes to daily newspapers (print). The explanation for this is that there are still many destinations that invest only in co-marketing campaigns with local Tour Operators. I am a huge fam of co-marketing in principle as it supports image advertising with a tactical call to action and it multiplies the destinations marketing budget. The only problem is that all-too-often the local tour operators are responsible for doing the media plan and they choose the media where they have the best deal (and not necessarily the best media for the job) and traditionally the daily newspapers have been the most generous with their bulk-purchase discounts to tour operators. Anyway this is the subject for future post so for now I’ll just mention that Colombia seem to have the richest and most creative mix of media and last year they made a huge impact on the market.